Insurance Claim Denials & Hiring Insurance Lawyers

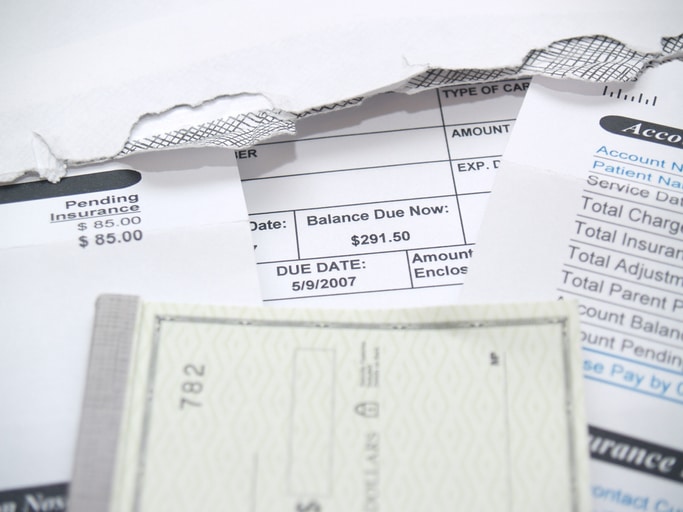

Insurance companies have a duty under the law to deal fairly and in good faith with their clients. Unfortunately, this doesn’t always occur. These cases are often referred to as insurance claim denials or bad faith claims.

Types of Bad Faith Claims to Hire an insurance dispute Attorney For

Here are some specific instances where bad faith insurance claims are most often seen. If you have experienced any of these situations, it’s important to talk to your personal injury and bad faith insurance attorney. We can even help you with a potential case before it turns into a bad faith claim.

Auto Insurance

If you have been in a car accident, chances are you need to contact your insurance company to report it and also, an Indiana car accident lawyer. However, you may find that your auto accident claim is much less than you thought it would be. You could also find your claim being completely denied. In many cases, this has to do with the type of auto insurance policy you have. However, in other cases, you may be experiencing a bad faith claim.

It’s important to have a solid understanding of your auto insurance claim. Our auto accident and insurance bad faith attorneys can review your insurance claim if you need help. We may find that we can build a base for a bad faith insurance claim. Some of the coverage types you should be aware of include:

- Collision damage

- Comprehensive coverage

- Medical payment coverage

- Personal injury protection

- Bodily injury liability

- Property damage liability

- Uninsured motorist coverage

If your insurance company provides reason and justification for the settlement offer or denial of insurance, it’s always good to double check with your attorney. A denied insurance claim lawyer at WKW will help you understand either why your claim was denied, or handle the denial claim if it was made in bad faith.

Life Insurance Policies

Losing a loved one is a hard and emotional time in one’s life. Life insurance policies are meant to help and support families when a loved one has passed away. If your life insurance policy is through a moral insurance company, the hope is that full coverage will be granted so you can mourn and heal your loss. However, there are unfortunate circumstances when unethical, profit-driven insurance companies take advantage, denying claims on the basis of misdirected language.

We want to make sure that, during this hard time, you get the full compensation that you deserve. Call a bad faith insurance attorney at our office if you suspect you have been taken advantage of by your insurer.

When to Hire a Denied Insurance Claim Lawyer

Make sure you hire a lawyer for insurance claims before you accept any settlement offer. If you accept the settlement, or if your case has already been denied, then a whole other process needs to happen. There must be an appeal and the lawsuit must go through the federal court systems.

Although this may not sound bad, the process is limiting; you cannot add any new evidence to your case. You must work only with what you have, which places constraints on evidence and building a strong case.

In summary, hire a denied insurance claim lawyer before your claim is officially denied.

Do Insurance Lawyers Really Help?

Suing an insurance company for denying a claim is a complicated process. First, the claim must be founded in evidence. Additionally, insurance companies will exploit the position of people who are not represented by an insurance attorney. They may make a low offer that seems reasonable, but isn’t.

Identifying when a settlement offer is made in bad faith takes experience and a keen eye for what to look for. Having a lawyer for insurance claims means that you have legal backing and representation to be fully supported.

Bad faith insurance claims are difficult to fight. Working with a lawyer for suing an insurance company will increase the odds of winning your claim. Your insurance lawyer at WKW will make sure that your case is handled in a timely manner, and built on strong evidence to go up against the bad faith insurer.

Contact an Insurance Claim Denial Attorney Today

The Indiana bad faith insurance law attorneys at Wilson Kehoe Winingham have settled multiple cases against insurance companies for unfair denial of large claims, ranging from fire losses and roof collapses to disability claims made by physicians and other professionals.

Firm partner Bill Winingham has argued before the Indiana Supreme Court to continue to ensure that Indiana holds insurance companies accountable for their lack of good faith in denying claims.

If you—or a loved one—have been denied compensation for a legitimate insurance claim, we urge you to contact the Indianapolis insurance claim denial attorneys here at WKW. We can help you get the compensation you deserve.

Contact Us

Let WKW put our experience to work for you. Contact us for your free case evaluation.

Or, call us today at (317) 920-6400